House Explanation

Disclaimer: We have sought to write everything honestly, yet “Who can understand his errors? Cleanse me from secret faults.” Psalm 19:12.

Introduction

In 2013 our home was foreclosed. But this is not the whole story. Criminal forgery and fraud have been committed by the bank(s) who foreclosed. Nearly three years after the foreclosure we are still in the house, but are in legal battles. Unfortunately the courts today are not giving us justice or upholding our rights. Please read this and please be careful about making assumptions.

What the Banks Say

Before we explain why our foreclosure was illegal, you should know what the banks say. Although some of it may contain elements of truth, much of it is lies:

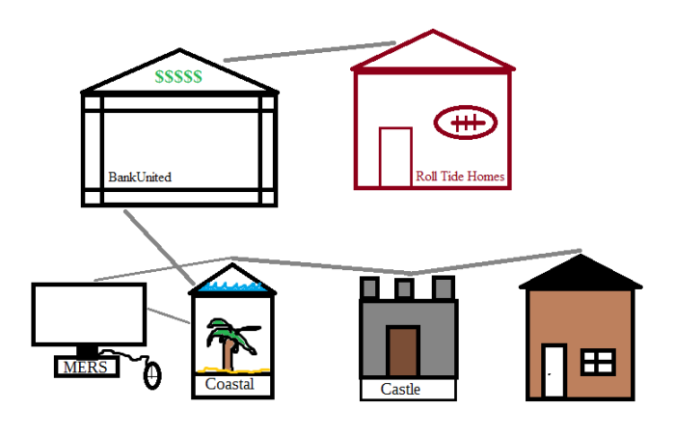

In 2001 the Gravelings came to Castle Mortgage Corporation (“Castle”) and signed a note and mortgage. The note and mortgage were sold several times. These parties owned them:

- Castle

- Coastal States Mortgage Corporation (“Coastal”)

- Mortgage Electronic Registration Systems, Inc (“MERS”)

- Coastal (again)

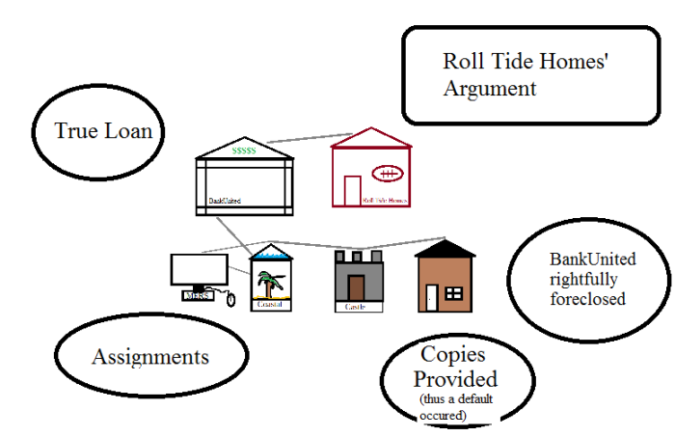

The Gravelings disputed their debt with Coastal because of concerns of fraud. Coastal sent the Gravelings copies of the note and mortgage and the assignments (showing the transfer of the note and mortgage) to prove that Coastal could foreclose.

The Gravelings were not satisfied with the copies, and so defaulted because they did not resume paying their mortgage. Coastal assigned (sold) the mortgage to BankUnited, N.A. (“BankUnited”), who sent copies of the note and mortgage and assignments to the Gravelings. After more similar correspondence with the Gravelings, BankUnited foreclosed.

The Gravelings brought the issue to federal court. BankUnited argued that the Gravelings had no cause to bring the matter to court, and a judge dismissed the Graveling’s claims.

Bank United then sold their title to the property (which the Gravelings still occupied) to Roll Tide Homes, LLC.

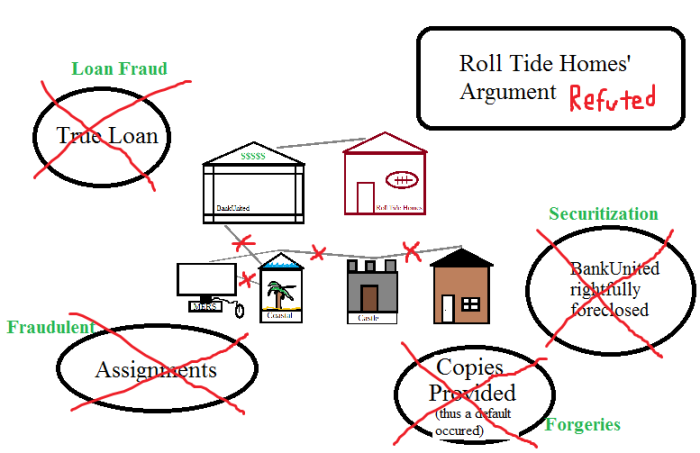

In summary, the house was used as collateral in a loan from Castle, and then the loan was sold a bunch of times, but ultimately Roll Tide Homes should own the house:

Roll Tide Homes brought an ejectment action to the county court, (so now there are two court cases) stating that because of the foreclosure, Bank United owned the Graveling’s home and had sold it to RTH, so the Gravelings needed to leave:

The judge agreed with RTH’s story. So why are the Gravelings not just leaving their home?

Problems With the Bank’s Story

All of what the banks wrote seems rather straightforward, and it may at first seem that we are wrong. But the truth is that we are trying to be honest and fair, and there are huge problems, violations of law, and assumptions in the bank’s story.

To begin with, at the time of foreclosure the dispute over the debt was still ongoing. The Fair Debt Collection Practices Act (“FDCPA”) states that people have the right to dispute an alleged debt and not pay until the debt is verified. Our debt was never verified because the banks only sent us what they said were copies of the note and mortgage. These “copies” actually turned out to be criminally forged documents. Does that sound like verification to you?

Here are some of the reasons we have been disputing the debt:

A Real Loan?

Our dispute was partially based on the question of whether we received a real loan. Most people think that banks keep deposits and pay a small amount to depositors for the use of their money, and then loan out these deposits at a higher interest rate to make money. The Federal Reserve banks say otherwise:

“It may not seem to make much sense, but banks actually ‘create’ money when they lend it.”

– The Federal Reserve Bank of Dallas

In a publication entitled “Repeat After Me: Banks Cannot And Do Not “Lend Out” Reserves” Standard and Poor’s wrote:

“Banks lend by simultaneously creating a loan asset and a deposit liability on their balance sheet. That is why it is called credit “creation”–credit is created literally out of thin air (or with the stroke of a keyboard). The loan is not created out of reserves. And the loan is not created out of deposits: Loans create deposits, not the other way around.” (emphasis added)

In Modern Money Mechanics, the Federal Reserve Bank of Chicago stated:

“What, then, makes these instruments – checks, paper money, and coins – acceptable at face value in payment of all debts and for other monetary uses? Mainly, it is the confidence people have that they will be able to exchange such money for other financial assets and for real goods and services whenever they choose to do so.”

“Of course, they [the banks] do not really pay out loans from the money they receive as deposits. If they did this, no additional money would be created. What they do when they make loans is to accept promissory notes in exchange for credits to the borrowers’ transaction accounts.” (emphasis added)

This quote from Modern Money Mechanics, which explains some of the history of banking, makes the concept easier to grasp:

“In the absence of legal reserve requirements, banks can build up deposits by increasing loans and investments so long as they keep enough currency on hand to redeem whatever amounts the holders of deposits want to convert into currency. This unique attribute of the banking business was discovered many centuries ago.

It started with goldsmiths. As early bankers, they initially provided safekeeping services, making a profit from vault storage fees for gold and coins deposited with them. People would redeem their “deposit receipts” whenever they needed gold or coins to purchase something, and physically take the gold or coins to the seller who, in turn, would deposit them for safekeeping, often with the same banker. Everyone soon found that it was a lot easier simply to use the deposit receipts directly as a means of payment. These receipts, which became known as notes, were acceptable as money since whoever held them could go to the banker and exchange them for metallic money.

Then, bankers discovered that they could make loans merely by giving their promises to pay, or bank notes, to borrowers. In this way, banks began to create money. More notes could be issued than the gold and coin on hand because only a portion of the notes outstanding would be presented for payment at any one time. Enough metallic money had to be kept on hand, of course, to redeem whatever volume of notes was presented for payment.

Transaction deposits are the modem counterpart of bank notes. It was a small step from printing notes to making book entries crediting deposits of borrowers, which the borrowers in turn could “spend” by writing checks, thereby “printing” their own money.” (emphasis added)

From those quotes it should be clear that banks don’t actually give real loans. This kind of “loan” is NOT the kind of loan we thought we were getting, nor the type of loan Castle represented it would give. Castle represented that it would give us a loan of its funds which we would have to repay, with interest, for the time we used Castle’s money.

Would it be right for someone to copy a $100 bill and then lend out the copy to someone? No. What if the copy was very good, and people couldn’t tell the difference? (After all, would it really hurt the borrower?) That would still not be right. It is the same situation here. When someone applies for a loan, the banks merely “create” the money (and thereby reduce the value of all the money in circulation). That is not right. Can you see why our founders wanted to have gold and silver money?

You may ask if the banks’ fraud makes it right to not repay though. Go back to the counterfeiting example: Would it be right to repay the counterfeiter? Perhaps you think everyone should go back to the same conditions they were in before the false loan was given. If that would be just, we want that. But first we need the banks to be honest about what they have done.

The banks’ fraud is complex and well hidden, but it violates God’s law. God says “You shall not steal,” nor use unjust weights and measures (certainly not something for nothing), and do not lie. This also violates mans law: It is fraudulent, there is no equity, and people are not given full disclosure.

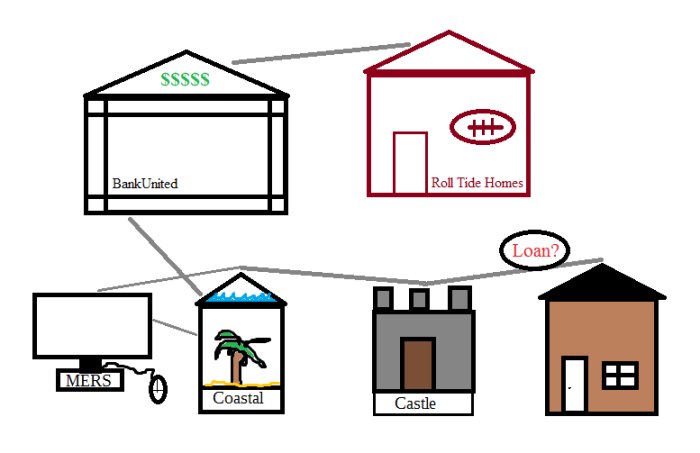

Whether you agree that most bank loans today are not real is important, but even if you’re unsure, think about this: We disputed our alleged debt. We asked to see the ledger books of the bank because this would make it clear whether a real loan was given. But instead the banks sent criminally forged documents that they said were copies of our note and mortgage.

Does this address our honest concerns about fraud? Did sending forged copies of the note and mortgage actually prove a true loan was given, and thus clear up the dispute? We certainly don’t believe so.

Securitization

Another argument we have raised in court is securitization. Securitize is a complicated term, but it’s basically the same thing as selling. Often banks will make loans (we’re only using this term to keep things simple), and then securitize them. Banks bundle a bunch of loans and categorize them into different risk categories, and then sell the loans to investors.

We had a securitization analyst, William McCaffrey, look at our “loan.” William McCaffrey has worked in the banking industry for over 30 years, worked for BankUnited (the foreclosing bank), is now a securitization analyst, and has testified in many court cases. He gave us an affidavit in which he states that Castle securitized our note a few months after it was created:

My research shows the corresponding Note has been securitized which is the process of aggregating a large number of Notes in what is called a mortgage pool and then selling security interests in that pool of mortgages to investors. These sales have fractionalized possession of the Note over many different investors.

The subject NOTE or Loan of said property was bundled with many other loans, sold to investors and ultimately placed into a FEDERAL NATIONAL MORTGAGE ASSOCIATION (FANNIE-MAE) TRUST SERIES 2001-50 referred to as the ISSUING ENTITY and formed pursuant to the Trust Agreement among the Seller, Depositor, Servicer, the Trust Oversight Manager and the Trustee. The Trust is also a REAL ESTATE MORTGAGE INVESTMENT CONDUIT (REMIC).

a. BANK UNITED and their successors in interest do not fall within any of the classifications of holders in due course on the subject loan.

b. BANK UNITED and their successors in interest have not suffered any financial loss relating to the loan.

c. BANK UNITED and their its [sic] successors in interest, did not possess legal STANDING necessary to initiate or conduct this foreclosure.”

-McCaffrey’s Affidavit (emphasis added)

Clearly, if Castle securitized (sold) the note in 2001, they could not have later sold it to Coastal several years later. But can McCaffrey’s affidavit be relied upon? An affidavit is a sworn statement taken under oath. Courts must treat affidavits as truth, unless rebutted by a counter affidavit. Many court cases support this. Here’s one:

[The court] may not assume the truth of allegations in a pleading which are contradicted by affidavit.”

– Data Disc Incorporated v. Systems Technology Associates Inc 557 F. 2D 1280 (emphasis added)

As mentioned above, securitization has the same effect as selling something: you no longer own it. Here’s a definition given on securitization and an explanation of the effects of it:

“SECURITIZATION” is the “conversion of bank loans and other assets into marketable securities for sale to investors.

For regulatory reporting purposes, a loan that is converted into a security and sold as an asset-backed security qualifies as a sale of assets. The seller retains no risk of loss from the assets transferred and has no obligation to the buyer for borrower defaults or changes in market value of securities sold.

-Barron’s Business Guides: Dictionary of Banking Terms 6th edition by Thomas P. Fitch, pp. 409-410 (emphasis added)

The idea that someone who securitizes something no longer owns it is also supported by law. The Code of Alabama (1975) Section 35-10A-2(a) states:

“(1) Any property, assets, or rights purported to be transferred, in whole or in part, in the securitization transaction shall be deemed to no longer be the property, assets, or rights of the transferor;

(2) A transferor in the securitization transaction, its creditors or, in any insolvency proceeding with respect to the transferor or the transferor’s property, a bankruptcy trustee, receiver, debtor, debtor in possession, or similar person, to the extent the issue is governed by Alabama law, shall have no rights, legal or equitable, whatsoever to reacquire, reclaim, recover, repudiate, disaffirm, redeem, or recharacterize as property of the transferor any property, assets, or rights purported to be transferred, in whole or in part, by the transferor;…” (emphasis added)

Let’s simplify:

-

McCaffrey’s affidavit says Castle securitized our loan.

-

Courts say affidavits must be treated as truth unless rebutted by affidavit. McCaffrey’s affidavit has not been rebutted, so it must be treated as truth. Therefore the loan was securitized.

-

The law states that when someone securitizes something, they lose all rights to it.

-

Therefore, when Castle securitized the loan, they lost all rights to the loan.

-

Therefore Castle had no right to sell the loan to Coastal. Coastal had no right to sell it to BankUnited. BankUnited had no right to it, and thus couldn’t foreclose or sell the home to Roll Tide Homes.

So now there are several things that completely destroy the bank’s story:

- The bank foreclosed without ever providing verification that it had the right to foreclose. The law clearly prohibits this.

- A true loan was never given to us.

- Our note was securitized (sold) by Castle, and so BankUnited had no right to foreclose.

Aside from saying that our claims are not plausible and that debt verification was provided to us because copies of the mortgage were sent to us, the banks have completely avoided our arguments. This of course begs the question: if the banks have an answer and/or evidence in opposition to our arguments, why aren’t they using them? Why avoid issues that could easily clear up the matter? Why only send forged notes and mortgages and assignments? Why not send something relevant (such as ledger records) that would address our concerns of the “loan” not a real loan?

Fraudulent Assignments

A chain is only as strong as its weakest link. The same is true for what is called a “chain of title.” If one party along the line cannot prove title, none of the subsequent parties can either. Because Castle securitized the loan, no other party they sold it to could claim to own the loan. But even if they could, there are problems with the assignments from one bank to another. (Assignments are like receipts.) Let’s examine some of the links between the banks.

The assignment from MERS to Coastal was executed by Teri Gress and notarized by Clara Hevia. However, both of them worked for Coastal, the company being assigned the note. Having a Coastal employee assigning something to itself is a clear conflict of interest, indicating fraud. Also, notary rules state that a notary must be impartial to anything they notarize.

Aside from the clear conflict of interest, it’s unclear if Teri Gress actually was a Vice President of MERS, as the assignment said she was. If she was not a vice president of MERS, she had no right to assign the mortgage and the assignment is entirely invalid. These days robo-signing, where banks hire people to pretend to be a bank president or vice president and then sign a bunch of documents, is very common, especially with MERS.

The assignment from Coastal to BankUnited has several major problems. It occured in August 2012. In February 2012 Fannie-Mae had terminated Coastal’s servicing rights on its 21,000 loans, and federal regulators were charging Coastal with fraud. Even if Coastal had received the loan from Castle, how could Coastal assign the the loan in August, when in February Fannie-Mae had terminated its servicing rights? By the way, in 2013, Coastal’s president, Patrick Mansell (who assigned the mortgage) pleaded guilty of fraud in the amount of over $18,000,000. (He’s currently in jail.)

Also note that Patrick Mansell signed the assignment on a different date than the notary. The writing is not perfectly clear, but it looks as if he signed it on August 7 and the notary signed it on August 30; it is at least clear that they signed it on different dates, as the banks have admitted. In another court case where it was unclear if the assignor stood before the notary, the court called the validity of the assignment into question.

Another argument we’ve used is that assigning a mortgage without the note is analogous to having the tail of a cow without the cow itself, because Coastal assigned the mortgage but not the note to MERS. There are also other arguments, but these should be clear enough.

So to quickly recap:

- Our dispute was still ongoing at the time of foreclosure; our honest concerns were never cleared up and yet the bank rushed to foreclose.

- No true loan was given to us.

- The note was securitized.

- The assignments have several major flaws.

Criminally-Forged “Copies of the Note and Mortgage”

Based on the banks’ own words doesn’t seem the loan was real. Based on Alabama securitization law it doesn’t seem Castle had any right to assign the mortgage. It doesn’t even seem the banks pretended to assign the mortgage correctly. But there’s more: The copies of the note and mortgage that the banks sent to us (which they always stated were “true and correct copies of the note and mortgage,” and sent as proof that we owed them) are forged!

How do we know this? They are different and contradictory. Logically, you could have a document, copy it, write something on the original document, copy it, and have two different copies, but any new writing on the second copy could not contradict the old copy. Two copies of an original document could be different (if something new was added to the original) but could never be contradictory.

At the present time there are three four (4) contradictory notes and three (3) contradictory mortgages, all of which the banks and their attorneys wrote were “true and correct copies of the originals.”

See for yourself. Here’s the top of the first page and the bottom of the last page of the four notes the banks sent. The red border around them was added by us.

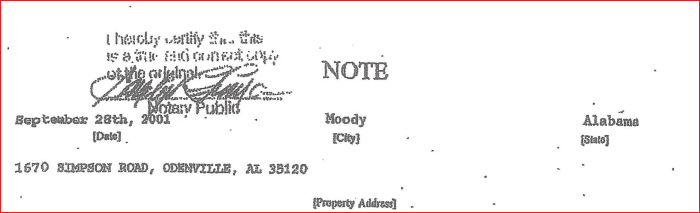

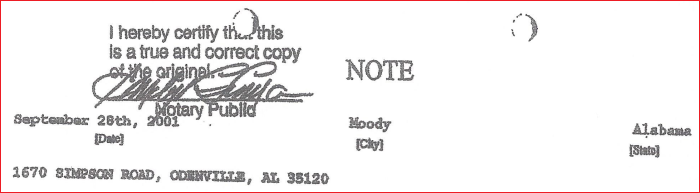

Top of the first page of note 1:

There is a notary’s signature, but because the signature is hard to read and there is no notary stamp or a “my commission expires,” there is no way to tell if this actually is a notary’s signature.

Bottom of the last page of note 1:

This “copy” was sent to us by Coastal in 2012. Because Coastal said that Castle had endorsed the note to them in 2007, how come there is no endorsement on the bottom of the last page of the note (where they usually are)? If we would present a check made out to someone else and it had no endorsement on it, would that prove that we are entitled to money from the check?

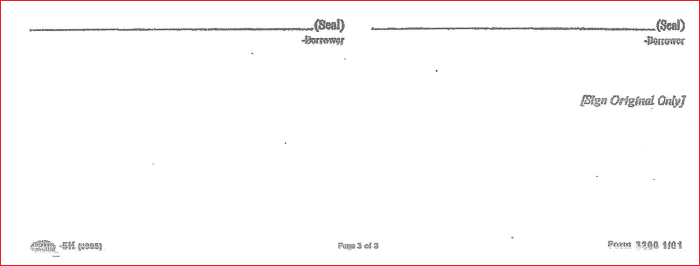

Top of the first page of note 2:

How come the notary signature is no longer there as in version 1, but suddenly the handwritten word “Graveling” mysteriously appears on the front? Also, this version shows two holes in the top of the page, which weren’t on the other copy.

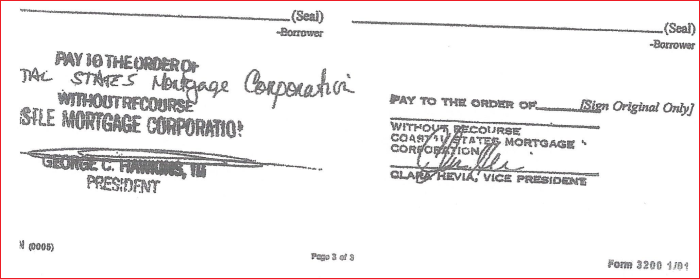

Bottom of the last page of note 2:

So now there’s an endorsement. But years after it was supposed to have taken place. Why wasn’t it on the first “true and correct” copy?

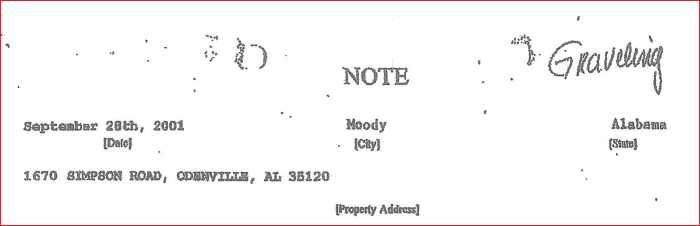

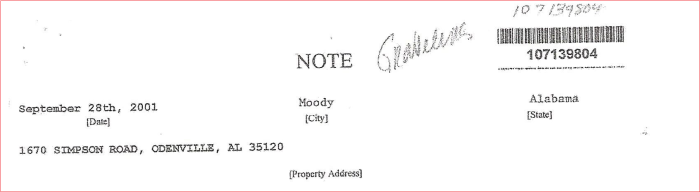

Top of the first page of note 3:

Now where did the handwritten “Graveling” go? And how come the notary’s signature is back?

Bottom of the last page of note 3:

A new endorsement. But look at the endorsement on the left. The way “Coastal States Mortgage Corporation” is written has suddenly changed! (Look at the space between “states” and “mortgage” and then look how the word mortgage is written and compare the two documents.) Interesting how over time ink can slowly move around a paper to look like someone else wrote it, isn’t it?

These contradictions clearly show these “notes” were forged. While looking through our records we recently discovered a fourth contradictory “copy of the note and mortgage!

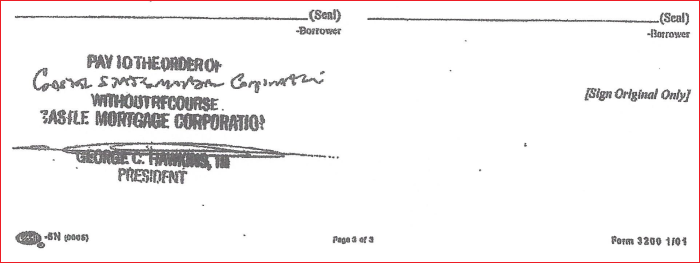

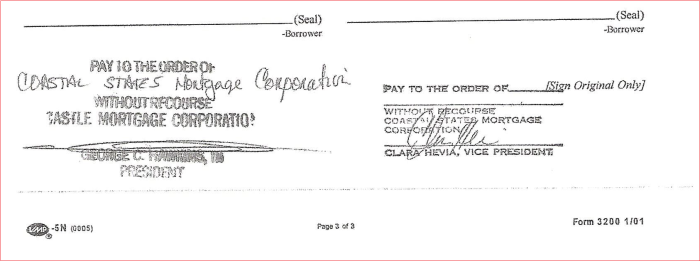

Top of the first page of note 4:

On this document the word “Gravelings” appears, again handwritten. But it is written differently and is in a different location than it was in “note 2.” This document is different from “notes 1-3” in that it has something that looks like a barcode and the number 107139804 and the same number handwritten on it. Clearly, all these copies are contradictory. They only way that is possible is if they were forged.

Bottom of the last page of note 4:

This is the same as the back page of “note 3,” but because the first page is different, it is of course a distinctly different document.

The mortgages are also different. For example, here are the top of the first page of the different versions:

Version 1:

Version 2:

How come the recording stamp and the scribbled numbers disappeared, but now there’s a notary saying it’s a true and correct copy of the original?

Version 3:

Oh look! The notary stamp is gone, the recording stamp is back, and some of the numbers are back, but where are the others?

Remember, these are all “true and correct copies of the original.” And they were sent to prove that the bank’s story is true and doesn’t have problems. Believe it or not, Bank United’s attorney once sent two different versions in the same envelope, stating that they were both true and correct copies of the original note and mortgage! This is forgery and fraud. Forgery is a second degree criminal felony in Alabama. Uttering (stating that a document is true when it is not) is also second degree felony in Alabama.

If this isn’t obvious to show there are problems in the banks’ story, what is? Clearly, their story is full of lies. And why did they resort to forging documents? Why not just show us the originals? We think it’s clearly because they don’t have them. This fits perfectly with the loan fraud and securitization arguments.

The link between our home and Castle is broken because of loan fraud. The link between Castle and Coastal is broken because of the securitization. The link between MERS and Coastal and the link between Coastal and BankUnited is broken because of fraudulent assignments. The banks sent “copies of the note and mortgage” to validate the debt, but these are forged.

This brings us back to our dispute, which was based on suspicions of loan fraud. You be the judge: Did the banks answer our concerns or add to them? Did the banks verify that they had given us a true loan and had the right to foreclose, or did their forgery and lies prove our suspicions valid? Was is right for the bank to simply foreclose without offering an explanation for their forged documents?

Strong-Arm Tactics

Unfortunately, there is more evil our adversaries have done. You have to understand that this has taken years, and as will be explained below, the courts are exceedingly corrupt (read Isaiah 1 and 59 to get a good picture). A big part of the banks’ strategy is intimidation, and they have tried to intimidate us. Although all the evidence is on our side, it can get extremely tiring and frustrating when no one in the courts will listen to us (their pensions are often backed by mortgage securities). After we point out all of the arguments outlined above, the bank sends the same story, never explaining the forgery, and so we have to write the same arguments over and over again.

For an example of some of the strong-arm tactics the banks employ, here’s a video of when BankUnited sent an agent to our home to tell us that the bank would hold an auction very next morning and we might have 30 minutes to get ourselves and our stuff out, or be forced out at gunpoint by the police. He admitted it sounded like what the Nazis did to the Jews. He also admitted that he felt guilty about his job, and a lack of assurance of salvation because of it.

The banks do tricks all the time. They’ve also damaged our reputations by telling people things about us that are simply not true. We tell people the truth, but it takes time, and people tend to shy away from us after hearing the banks’ lies.

Because they don’t have a leg to stand on, our adversaries use oppression, intimidation, and attrition. The banks’ illegal actions and forged documents are upheld by corrupt courts (see Isaiah 1:21-22).

Shouldn’t You Have Paid Your Debt?

If you’ve read the above it’s safe to believe that you have no doubt that the banks are not doing right. But, you might ask, does that justify you?

If you still are not sure that the banks have done wrong, please examine yourself carefully for bias. Look at the facts and evidence we’ve presented logically. Also, note that a lot of other people are starting to see that the banks are dishonest, e.g., see this memorandum which has several quotes from court cases (pp. 1- 6) and then an explanation of bank fraud. (We may or may not agree with everything that is written there; it is presented to show that other people realize modern banks aren’t giving true loans.)

Here are some facts that will hopefully help you see that we are seeking to faithfully obey God’s law and that we shouldn’t give up our home or pay the banks for it:

-

We have always said and continue to say that if anyone will prove their right to have us repay them, we will send money or yield the house.

-

Before we learned of the loan fraud, we had paid more than what our home was worth (the initial “loan”), and were then merely paying interest.

-

The loan was not a true loan. Just because the masses are not fighting our bad system does not mean it makes it wrong for us to fight the bad system.

- We asked for a loan not realizing the fraud. If we had known about all the fraud involved in the loans and then agreed to the “loan” contract and later disputed it, that would not be right. But we did not know about the loan fraud until years later.

-

Even if we did have to pay someone, it is NOT BankUnited or Roll Tide Homes. As shown above, the note was securitized (sold) by Castle, and Roll Tide Homes is simply trying to collect on a forgery, a counterfeit security little different than the $100 bill in the illustration earlier.

-

No one else (other than the banks mentioned) has claimed a right to our home.

-

We have offered to help Roll Tide Homes. First, we warned them (and everyone) not to try to buy our home from BankUnited. They “bought” our home from BankUnited for a huge discount (can you guess why not at full price?), but really they bought something BankUnited had no right to sell in the first place. After explaining our arguments and also sharing the gospel, we offered to give Roll Tide Homes more than what they had paid BankUnited. (We are no longer offering this because Roll Tide Homes has refused to respond to what we say and shows they don’t care what is right or wrong.)

- We’ve not been living here for free. We have been fighting people who are willing to resort to criminal forgery and intimidation to get what they want. It has been a fight that has consumed countless hours of our time. From a financial standpoint (not to mention emotional) it would be cheaper to forget what is right and wrong. (We are believing God to change this and show that standing for truth is worth it.)

-

God’s providence has been amazing throughout this matter. There are many fascinating details we can share, especially regarding answered prayers for mercy.

The crucial thing to remember is that the banks are the ones who committed fraud. Not us, not the people who sold us our home.

Even if you do not think it is just for us to have our home and you think that everyone should be brought back to the state they were in before the fraudulent loan/transaction took place, we should be given back all the money we paid towards the house, and have Biblical restitution for it from the banks, because, as proven above, the money we paid was ultimately stolen.

There might be other ways to have justice (it is made somewhat complicated by the fact that our monetary system is horrible), but as mentioned above, the banks first have to be honest. We seek to be righteous, and if we owe someone something we will seek to pay them, but when the banks are constantly telling blatant lies, committing criminal felonies, breaking the law left and right, and using intimidation tactics it is hard to have figure out exactly what actually did happen, and if there is anything we would rightfully owe anyone. What is clear is that they have wronged us and must make restitution.

Exactly how we are restored is important, but the first thing is to realize that we are not being dishonest and trying to get a free house. We want to be fair, honest, and just. The banks have used forgery and trickery, not us.

One Final Analogy

Just in case you’re still thinking, “but you still got a house,” we have another analogy. We could continue the counterfeiter example and ask if it would be right to pay the counterfeiter money or give them what we bought with their counterfeit money, but we can also use an analogy that focuses less on the loan fraud:

Let’s imagine that you buy a pickup truck from a used car dealer. He says it has a brand new engine and transmission and you agree to pay him with monthly payments. After a few months you notice the pickup is making some odd noise. When you open the hood it seems to you that the engine and transmission have serious problems, and might actually have been very old, not brand new. So instead of sending your next monthly payment, you call the used car dealer and tell him your concerns, and he says he will come over with his mechanic. He does come over, gives you a copy of the truck’s title, and looks at your truck with his mechanic, who tells you that everything is okay with the truck and that the engine is new (note that the banks never addressed our loan fraud concerns like this).

After the used car dealer leaves you go back inside to give the mechanic some water, and the mechanic tells you that he saw the used car dealer selling the truck’s title to someone else, and your should actually be paying that person; he swears that he is telling the truth. You ask the car dealer about it, and he quickly says that he still owns the title and will send you a copy of it. When you open the package, you find two copies of the title, and notice that they are different than each other, and also are different than the first copy he gave you. You ask him about it and ask to see the original contract, and he states that he absolutely refuses to allow you to see it. This adds to your concerns, and as you don’t want to pay someone who is stealing from you and others, you tell the used car dealer that you will only pay him if he shows that he is the one you should pay. He responds by saying that he’s going to repossess the pickup truck if you won’t pay him, and that he won’t give you anymore evidence that he owns the truck.

Should you start paying the used car dealer again? After all, you still have the truck, don’t you?Maybe you should pay for the truck, but the big question is whether you should pay the used car dealer, who you don’t think owns the title, and won’t prove otherwise. Would it be right for you to pay for the truck to someone whose only proof that they own the truck’s title is based on criminal forgery?

It’s the same type of situation with our home with regards to the securitization and criminal forgery arguments; the difference from the analogy is that we’ve never had our concerns regarding the loan fraud addressed. As you can see, saying “you have a house” is not very helpful: it does not address whether the banks have a right to our house. Of course we will pay them or give the house if they show that they have a right to our home. But it is not right for us to give them money when (1) we have evidence that the banks sold (securitized) the note and mortgage and (2) they claim to have the original note and mortgage but say they will not show them and instead only give forged copies.

Unjust Courts

As you probably know, our court system is far away from what the founders intended it to be, and the rulings the judges make are often not just. Our case has been no different. The courts don’t listen to the laws, facts, or arguments we share.

Trial by Jury

Most of us have heard the Seventh Amendment to the Constitution, which our founding fathers put into the Constitution after having learned by bitter experience that judges and courts can be corrupt:

“In Suits at common law, where the value in controversy shall exceed twenty dollars, the right of trial by jury shall be preserved, and no fact tried by a jury, shall be otherwise re-examined in any Court of the United States, than according to the rules of the common law.”

The Alabama law is also clear. Section 11 of the Alabama Constitution states, “That the right of trial by jury shall remain inviolate.” A trial by jury is a due process right. Alabama Code Section 12-2-7(4) states:

[The Supreme Court shall have authority]…”To make and promulgate rules…provided, that such rules shall not abridge, enlarge, or modify the substantive right of any party…and provided further, that the right of trial by jury as at common law and declared by Section 11 of the Constitution of Alabama of 1901 shall be preserved to the parties inviolate.”

Throughout this whole matter we have repeatedly demanded a trial by jury (actually, on our court documents we have “Trial by Jury Demanded” on the first page). This case clearly meets the criteria for a trial by jury because the matter in controversy is worth more than $20. Therefore the judges are Constitutionally required to give us a trial by jury.

But the courts have not even ever acknowledged that we have this right. Why? Think for a moment. Do you think unbiased people of sound mind would agree with the banks? Probably not. Judges today often have their retirements invested in the banks, and it seems that this prejudices the judges against homeowners and in favor of the banks, also perhaps because the rich banks might seem more important than normal people.

In any case, whether or not you agree with us about the banks’ forgery and fraud, it is clear that we ought to have a trial by jury where we can have our defenses heard and answered. We honestly believe Roll Tide Homes’ claims to title to our home are based only on criminally forged documents. Even if we were wrong and we should give up our home, is it right for the judges to just take away our home without ever explaining to us why our concerns are not valid? If we were wrong would it give the judges the right to violate our Constitutional right to a trial by jury?

Summary Judgment

In their ejectment action, Roll Tide Homes motioned for summary judgment, stating that no material (important and relevant) facts were in dispute. Basically that means they are saying that is so obvious they are right that no trial or trial by jury is needed. You might think this sounds insane. We agree. We disagree with everything they say! We have clear evidence that we are right, and the only evidence they have is forged and fraudulent.

We asked for the judge not to grant their request, stating that we have a right to a trial by jury, because the matter in controversy is over twenty dollars. Even if there are laws saying that summary judgment can be granted, the Constitution states that we have a right to a trial by jury, and as the Supreme Court ruled long ago:

Thus, the particular phraseology of the Constitution of the United States confirms and strengthens the principle, supposed to be essential to all written Constitutions, that a law repugnant to the Constitution is void, and that courts, as well as other departments, are bound by that instrument.

–Marbury v. Madison 5 U.S. 137 (emphasis added)

We also opposed Roll Tide Homes’ motion for summary judgment, stating that even if we didn’t have a right to a trial by jury, they still should not have summary judgment: Rule 56(c)(3) of the Alabama Rules of Civil Procedure should have prevented summary judgment:

“The judgment sought shall be rendered forthwith if the pleadings, depositions, answers to interrogatories, and admissions on file, together with the affidavits, if any, show that there is no genuine issue as to any material fact and that the moving party is entitled to a judgment as a matter of law.” (emphasis added)

No genuine issue as to any material fact means that all the relevant facts are clear and indisputable. The facts are clear, but in our favor, not Roll Tide Homes!

For example, McCaffrey’s affidavit says securitization occurred. The law (Ala. Code 35-10A-2) proves this means the banks had no right to the “loan” after that. Because there are no affidavits rebutting McCaffrey’s, the court must treat the fact that Castle securitized the note as true. This relevant fact is in our favor, and this single fact destroys Roll Tide Homes’ entire argument, leaving them with no right “whatsoever” to our house.

Anyway, a hearing on the matter was held where we explained all these facts and arguments to the judge, who asked if we’d written them in our papers. We said we had, and he said he’d read them.

In spite of the clear requirements of law, facts, and evidence, the judge granted summary judgment to Roll Tide Homes. He basically copied, word for word, the list of “facts” that Roll Tide Homes’ attorney had alleged were true, even though the evidence proved contrary.

How did he get around all the things we had argued? He simply had one sentence in which he wrote that he reviewed and found “no merit in [the] arguments and pleadings” we had presented.

That is completely wrong, but even if it was correct, he had to explain why our arguments were wrong. He could not just wave his hand and say “you’re wrong.” That’s not justice. Court cases, which we have cited, say the same. Do you see why our founders protected the right to a trial by jury?

Straining at Gnats and Swallowing Camels

Just in case you’re not convinced the judges are not obeying the law, here’s one more clear example: We had brought a lawsuit against several of the banks before Roll Tide Homes came along. The original “lender” (Castle) did not obey the law by answering the lawsuit on time. This happened after we had asked God to let them default because the courts would probably be biased toward the banks. Because Castle defaulted, the following rule, Rule 55 of the Federal Rules of Civil Procedure, is supposed to be followed:

(a) Entering a Default. When a party against whom a judgment for affirmative relief is sought has failed to plead or otherwise defend, and that failure is shown by affidavit or otherwise, the clerk must enter the party’s default.

(b) Entering a Default Judgment.

(1) By the Clerk. If the plaintiff’s claim is for a sum certain or a sum that can be made certain by computation, the clerk—on the plaintiff’s request, with an affidavit showing the amount due—must enter judgment for that amount and costs against a defendant who has been defaulted for not appearing and who is neither a minor nor an incompetent person.

All of the criteria for default to be given by the clerk were met. We thus went to the clerk and asked for default to be entered. She at first said the local rules said the judge had to decide. We looked and found they don’t say that, so we went back to her (a different day). She then said the Federal Rules say she “may” enter default, not “must.” This is a blatant lie (see above). When we and several witnesses went and asked again on another day (see how much time this takes?), she had marshals escort us out of the building.

So we asked the judge to make her do what’s right. The judge didn’t give us the default, stating that she preferred to rule on the merits. But do judge’s preferences trump the law? She also said that because we had mailed the package containing our complaint (instead of having the clerk mail it) she didn’t have to grant default judgment. This is nonsense. A court clerk had told us it was fine to mail the complaint ourselves, and even if it wasn’t, what does that have to do with the above law?

Of course, what the judge did is in opposition to the law. (Isn’t the law supposed to be over everyone?) It just shows how the courts strain at gnats and swallow camels. We appealed her ruling, but so far the appeals court has ignored our the law and only repeated the same things about how they prefer not to give default judgments.

Assumptions and Injustice of the Courts

Now, as we were saying, naturally we appealed the judge’s absurd ruling which granted Roll Tide Homes summary judgment. We explained all of the above facts to the appeals court, and explained that what the lower judge had done was unjust, and that his ruling was required to have but did not have an explanation. We also again demanded a trial by jury.

The appeals court issued a “no opinion” ruling, which means they think the ruling of the lower judge was obviously correct.

Can you see how wicked this is? Basically, the ruling overlooks and supports fraud, forgery, and stealing. It is against the right to a trial by jury, due process rights, and justice.

We have now appealed to the Alabama Supreme court. Pray that they will be more just than the appeals court.

We have also brought the criminal forgery to the police. We desire restitution from the banks (rather than having them go to jail – for 2nd degree forgery they can go to jail for up to 10 years) but so far the courts are being corrupt and so we are forced to seek other means of justice in an effort to protect ourselves and our children.

A Quick Recap

Some of the arguments we have used:

- We did not default; we disputed an alleged debt (according to federal law) and asked for proof. No real proof was given to us.

- Alabama law states that because securitization occurred, the bank had no right to foreclose.

- According to Federal Reserve bankers, we were not given a true loan.

- The “true and correct copies” of the note and mortgage were criminally forged.

- The assignments the banks have presented have major problems with them.

- We should have a trial by jury, according to the Constitution.

- Even if the banks and judges had proof that we were wrong or our arguments were illogical, they would have to to explain that to us; they could not just take our home without addressing our concerns.

Here is what the court’s have said, partly by their actions:

- Judges can decide when people have a right to a trial by jury.

- Judges don’t have to follow the law if they don’t want to.

- If someone has honest concerns and defenses, and the evidence is completely in their favor, it is just to rule against them and take away their house without any explanation as long as a judge writes that their arguments don’t have merit.

God is in Control

Despite what the courts have done, God is in control, and He works everything according to His perfect will. We trust Him and are praying to Him.

After what the banks have done, you might ask yourself if you’re missing something simple. We have asked ourselves this many times. But whenever we review the history of this matter and the evidence we come to the same conclusion: We honestly asked for our concerns of loan fraud to be cleared up, and we did so according to the Constitution, but the banks responded with criminally-forged documents and blatant lies. Think of the passages in the Bible about how justice is not upheld and how judges become corrupt when a land turns from the Lord.

We still have home though, because of God. What God has done is amazing. How often will a bank default? Who caused the banks, when forging the documents, to create multiple contradictory ones instead of a single consistent one? Why didn’t the assignor appear before the notary? Why have banking authorities admitted their loan fraud in their publications? It can only be God. He is faithful and in control!

What You Can Do Now

God is in control. He also gives us duties.

Please pray for us. Pray for our adversaries to get right with the Lord and in the meantime to have none of their works prevail. Pray that the judges will just, and if they don’t want to be just, that God will force their hands; also pray that judges across America will become just or face justice themselves. Pray for other authorities (such as the police) to do what is right. Pray that God gives us our home.

Thank you so much for taking the time to read this. We deeply appreciate it.

If you agree with us, please let know. We cannot tell you how much it would encourage us to know that you agree that we are right. If you have any constructive criticism or advice about what we could do to ensure that justice occurs in the courts, that would also be appreciated.

We also ask that you send us a message (by comment or by emailing at jgraveling@windstream.net) stating something such as:

“I have read about the Graveling’s situation at anchoroftruth.org/house-explanation/ and consider what the courts have done to be extremely unjust. As anyone can see, the banks’ own evidence shows clear evidence of criminal forgery and fraud. It seems that the courts are supporting the violation of the Graveling’s rights. According to the Constitution the Gravelings should have a trial by jury where their defenses can be heard. – [name]”

Recent Comments